Rebuilding Confidence on the Road to Financial Freedom

Debt is not only a financial burden—it can take an emotional toll, creating feelings of stress and uncertainty. Rebuilding confidence

We believe everyone deserves a chance to regain control of their financial life. Our goal is to provide simple, clear, and trustworthy information that helps people understand their options and take steps toward a healthier financial future.

A structured plan that helps you repay your debts over time with lower interest rates and simplified monthly payments for better control.

Combine multiple high-interest debts into a single loan or payment to make repayment easier, reduce stress, and often lower overall interest costs.

Negotiate directly with creditors to reduce the total amount you owe, making it more manageable and realistic to pay off your debts successfully.

Get professional guidance on budgeting, debt repayment strategies, and making smarter financial decisions to regain stability and confidence.

Understand your options, rights, and the potential financial, legal, and long-term personal consequences before considering bankruptcy as a last resort.

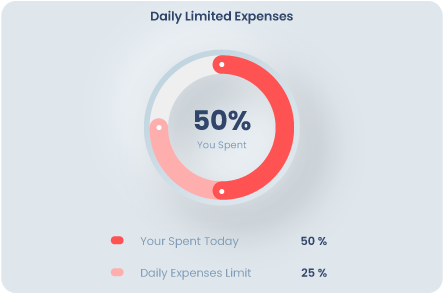

Learn how to track expenses, cut unnecessary costs, and create a financial plan that supports your goals.

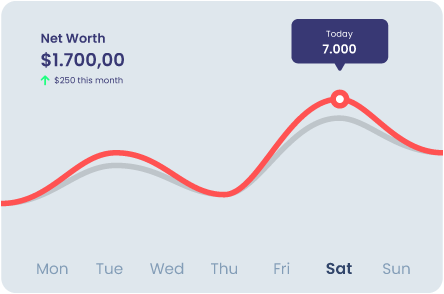

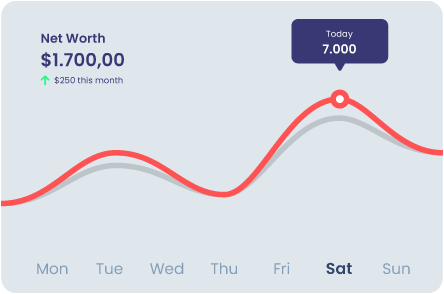

Use online tools to estimate payoff timelines, compare strategies, and track your progress toward being debt-free.

Discover practical steps to rebuild your credit history and improve your score for future financial stability.

We believe in honesty, clarity, and compassion. Our mission is to provide simple guidance, transparent information, and reliable resources so you can make confident financial decisions and move toward a debt-free future.

From practical tools to supportive advice, we’re here to make your journey easier. Our focus is on giving you the knowledge and encouragement you need to take control of your debt and build long-term financial stability.

We understand how overwhelming debt can feel, which is why we prioritize honesty and support. With straightforward information and helpful resources, we empower you to make better choices and take positive steps toward financial peace of mind.

Don’t let debt hold you back. Explore easy solutions, stay informed, and take meaningful steps toward long-term stability.

Debt relief refers to methods and strategies that make it easier to manage, reduce, or eliminate debt, helping you move toward financial stability.

Some options may temporarily impact your credit score, but over time, responsible repayment and better money management can help improve it.

The right choice depends on your financial situation, debt amount, and long-term goals. Exploring different approaches can help you decide what fits best.

Yes, many people manage debt independently through budgeting, repayment strategies, and discipline. However, professional guidance can provide additional support.

It varies depending on the method you choose and the amount of debt. Some approaches take months, while others may take several years to complete.

Debt is not only a financial burden—it can take an emotional toll, creating feelings of stress and uncertainty. Rebuilding confidence

Communicating directly with creditors can feel intimidating, but it’s often the first step toward taking control of your financial future.

Student debt has become one of the biggest financial challenges for individuals and families, but relief programs exist to make